What Are Central Bank Digital Currencies (CBDCs)?

Central Bank Digital Currencies (CBDCs) are a new form of digital money issued and regulated by a country’s central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, CBDCs are state-backed and represent a digital form of a nation’s fiat currency. These currencies combine the convenience of digital transactions with the trust and legal backing of a central authority, offering a seamless and secure payment system.

CBDCs are designed to function as a medium of exchange, store of value, and unit of account, just like traditional paper currencies. However, their digital nature allows for instantaneous transactions, reduced costs, and improved transparency across the financial system.

Types of CBDCs: Retail vs. Wholesale

There are two main types of CBDCs, each targeting different use cases:

Retail CBDCs

Retail CBDCs are intended for general public use, enabling individuals and businesses to conduct everyday transactions. They function much like digital cash and are accessible through mobile apps, smart cards, or digital wallets. Retail CBDCs can be account-based or token-based, depending on how user identity and transactions are verified.

Wholesale CBDCs

Wholesale CBDCs are designed for use by financial institutions, such as banks and payment processors. They facilitate interbank settlements and large-scale financial operations, improving efficiency, reducing settlement risks, and streamlining liquidity management.

Key Features of CBDCs

CBDCs possess several key features that distinguish them from both physical cash and cryptocurrencies:

- Centralized Authority: Issued and regulated by the central bank.

- Legal Tender: Recognized as official currency, fully backed by the government.

- Programmable Money: Capable of smart contract integration for automated compliance and transactions.

- Traceability: Enables robust monitoring and tracking to combat fraud and illicit activities.

- Financial Inclusion: Extends banking services to unbanked or underbanked populations.

- Interoperability: Designed to integrate with existing financial systems and global payment networks.

Benefits of Central Bank Digital Currencies

1. Enhanced Payment Efficiency

CBDCs enable instant, low-cost, and cross-border transactions, eliminating intermediaries and reducing operational friction. This leads to faster settlements, improved cash flow, and optimized supply chains for businesses.

2. Financial Stability and Control

With CBDCs, central banks can exercise direct control over monetary policy, interest rates, and inflation, offering greater resilience during financial crises. Real-time data from digital currencies allows better economic forecasting and policy decisions.

3. Combating Financial Crime

The traceability of CBDCs allows governments to monitor illicit activities, such as money laundering, tax evasion, and terrorism financing. Programmable oversight ensures transactions are compliant with regulations, enhancing overall security.

4. Reducing Costs of Physical Cash

Maintaining and distributing paper currency is expensive. CBDCs eliminate many of these costs, including printing, transportation, and storage, making them a cost-effective alternative to traditional cash.

5. Promoting Financial Inclusion

CBDCs can reach populations with limited access to traditional banking infrastructure. By using mobile wallets or smart devices, even those in rural or underserved areas can participate in the formal financial system.

Challenges and Concerns Around CBDCs

Despite the potential benefits, CBDCs also raise significant concerns:

1. Privacy Issues

The ability of governments to monitor every transaction may lead to loss of personal privacy and raise concerns about mass surveillance.

2. Cybersecurity Threats

As digital assets, CBDCs are susceptible to hacking, cyberattacks, and system vulnerabilities. Ensuring robust encryption, secure architecture, and disaster recovery plans is critical.

3. Disintermediation of Banks

Direct CBDC issuance might lead to reduced reliance on commercial banks, potentially destabilizing the existing financial ecosystem and threatening the credit creation process.

4. Technological Barriers

Implementing a secure, scalable, and user-friendly CBDC infrastructure requires significant technological investment, coordination, and public trust.

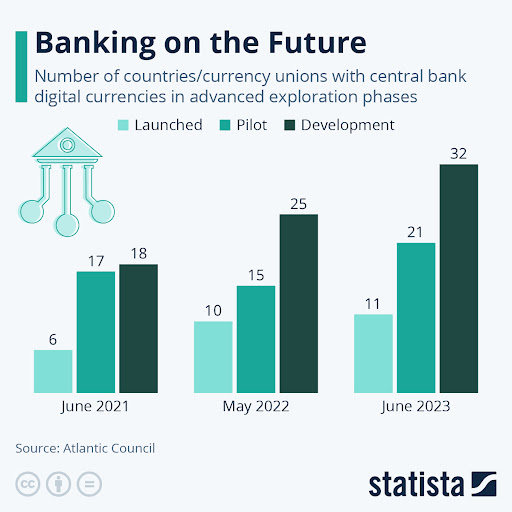

CBDCs Around the World: Global Developments

Countries across the globe are actively exploring or piloting CBDC projects. Here are some notable examples:

China: Digital Yuan (e-CNY)

China is leading the CBDC race with its Digital Yuan, already rolled out in several cities. The People’s Bank of China aims to enhance payment systems and reduce dependence on the dollar.

European Union: Digital Euro

The European Central Bank is developing a Digital Euro to maintain monetary sovereignty and ensure safe, efficient digital payments within the eurozone.

United States: Digital Dollar

The Federal Reserve is exploring the Digital Dollar to address financial innovation, stablecoins, and maintain the USD’s global dominance in digital transactions.

India: e-Rupee

India launched pilot projects for the Retail and Wholesale Digital Rupee, focusing on increasing financial inclusion and modernizing the payment landscape.

Bahamas: Sand Dollar

The Bahamas was among the first to launch a live CBDC, the Sand Dollar, aimed at improving access to financial services in remote islands.

CBDCs vs. Cryptocurrencies: Key Differences

While both CBDCs and cryptocurrencies exist in the digital realm, they are fundamentally different:

| Feature | CBDCs | Cryptocurrencies |

|---|---|---|

| Issuer | Central Banks | Decentralized Entities |

| Regulation | Fully Regulated | Partially or Unregulated |

| Legal Tender | Yes | No |

| Volatility | Stable | Highly Volatile |

| Anonymity | Limited | Often High (e.g., Bitcoin) |

| Use Case | National Payments | Investment, Transactions, Store of Value |

The Role of CBDCs in the Future Economy

CBDCs are not just a new payment mechanism—they represent a transformation of the global monetary system. By combining the efficiency of digital technology with regulatory oversight, CBDCs could potentially:

- Reshape international remittances and cross-border trade

- Enhance the efficiency of central bank operations

- Act as a counterbalance to private digital currencies

- Support climate goals by reducing paper and coin production

CBDCs are also likely to integrate with emerging technologies like blockchain, artificial intelligence, and IoT, expanding their utility across various sectors.

How Businesses and Consumers Can Prepare

The rise of CBDCs will demand adaptation and digital literacy. Businesses should:

- Update payment systems to support digital currencies

- Invest in cybersecurity and compliance tools

- Educate staff and customers on safe CBDC usage

Consumers, meanwhile, should explore CBDC-compatible wallets, learn about privacy settings, and stay informed about policy changes from central banks.

Conclusion: Embracing the Digital Currency Era

Central Bank Digital Currencies are poised to redefine how we use, manage, and perceive money. While challenges remain, the momentum behind CBDCs is undeniable. As nations race toward digital transformation, staying informed and prepared is no longer optional—it’s essential.

If you want to read more information about how to boost traffic on your Website just visit –> The Insider’s Views.

Leave a Reply