Blog

-

What Do We Mean by “Crypto Future”? A Comprehensive Breakdown

Could you clarify what you mean by “crypto future”? Are you referring to:

- Cryptocurrency futures contracts (financial derivatives used for trading)?

- The future outlook of cryptocurrency as a technology and market?

- A specific project or platform named “Crypto Future”?

Here’s a brief overview of each in case you’re asking generally:

1. Cryptocurrency Futures (Trading Instruments)

- What they are: Agreements to buy/sell a cryptocurrency at a predetermined price at a specified time.

- Used for: Hedging or speculating on the future price of cryptocurrencies.

- Common platforms: Binance Futures, CME, Bybit, Kraken.

- Popular assets: BTC, ETH, SOL, etc.

2. Future of Cryptocurrency (Industry Outlook)

- Trends:

- Increased regulation (MiCA in EU, SEC actions in the US).

- Institutional adoption (BlackRock, Fidelity ETFs).

- Layer 2 scaling (Arbitrum, Optimism).

- DeFi and RWAs (real-world assets) integration.

- CBDCs and stablecoins.

- Challenges: Regulatory uncertainty, scalability, security, mainstream UX.

3. “Crypto Future” (as a specific name or project)

If you meant a company, token, or project called “Crypto Future,” please provide more context or specify the platform or website.

What Do We Mean by “Crypto Future”? A Comprehensive Breakdown

The phrase “crypto future” can have multiple interpretations depending on the context in which it’s used. It might refer to:

- Cryptocurrency futures contracts — financial instruments used in trading.

- The future of cryptocurrency — the broader outlook of the crypto industry as it evolves.

- A project or platform named “Crypto Future” — a specific entity, token, or company.

To clarify these possibilities, let’s explore each in detail.

1. Cryptocurrency Futures (Trading Instruments)

What are cryptocurrency futures?

Cryptocurrency futures are financial derivatives that allow traders to speculate on the future price of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) without actually owning the underlying assets. These contracts obligate (or allow, depending on the type) the parties to buy or sell a crypto asset at a predetermined price at a specific date in the future.Key Concepts:

- Leverage: Traders can use borrowed funds to amplify gains (or losses), sometimes up to 100x.

- Hedging: Institutions and miners use futures to protect against market volatility.

- Speculation: Many traders attempt to profit from price movements without holding the actual coins.

Types of Crypto Futures:

- Perpetual contracts: No expiration date; popular on platforms like Binance and Bybit.

- Standard futures: Expire on a specific date; commonly used on regulated exchanges like CME.

Popular Futures Trading Platforms:

- Binance Futures

- Bybit

- OKX

- CME Group (Chicago Mercantile Exchange)

- Kraken Futures

Example:

A trader believes the price of Bitcoin will increase in the next month. They enter into a long BTC futures contract at $60,000. If BTC rises to $65,000, they can profit from the $5,000 difference per contract (depending on size and leverage).

Risks:

- High volatility: Crypto markets are notoriously unpredictable.

- Liquidation: Traders can lose their entire position if the market moves against them.

- Complexity: Requires strong understanding of derivatives and market dynamics.

2. The Future of Cryptocurrency (Industry Outlook)

When people refer to the “crypto future,” they may be talking about the long-term trajectory of the cryptocurrency ecosystem as a whole. This includes the development of technology, adoption trends, regulation, innovation, and its integration with traditional finance.

Major Trends and Themes:

✅ Institutional Adoption:

- BlackRock, Fidelity, and Grayscale have entered the space with Bitcoin ETFs and other financial products.

- Traditional banks are exploring custody and tokenization services.

✅ Regulation and Policy:

- EU’s MiCA (Markets in Crypto-Assets) regulation brings structured oversight.

- U.S. SEC and CFTC actions are reshaping which assets are considered securities or commodities.

- Global divergence in regulation: Crypto-friendly (e.g., UAE, Singapore) vs. restrictive (e.g., China).

✅ Layer 2 Scaling Solutions:

- Networks like Arbitrum, Optimism, zkSync, and StarkNet help scale Ethereum by reducing fees and increasing transaction speed.

- Layer 2s are crucial for mainstream adoption of decentralized apps (dApps).

✅ DeFi and Real-World Assets (RWAs):

- Decentralized finance platforms like Aave, MakerDAO, and Compound are integrating real-world assets like bonds and real estate.

- Tokenization is a growing trend—bringing off-chain assets on-chain securely and transparently.

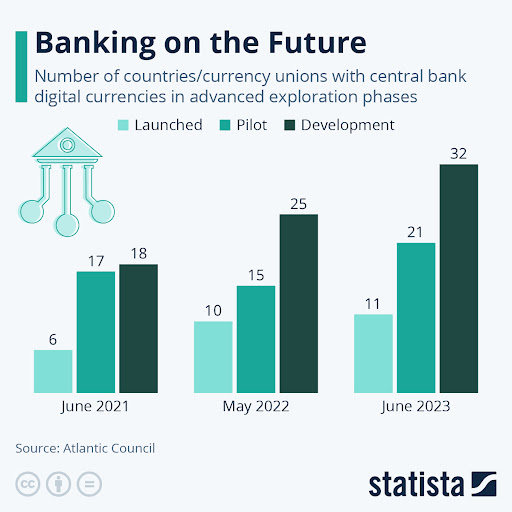

✅ Stablecoins and CBDCs:

- Stablecoins (e.g., USDT, USDC, DAI) are now essential for trading, remittances, and payments.

- Governments are exploring Central Bank Digital Currencies (CBDCs) to modernize money (e.g., Digital Yuan, e-Naira, Digital Euro).

✅ Web3 and Decentralized Identity:

- Web3 emphasizes user ownership of data, digital identity, and value creation.

- Projects like ENS, Lens Protocol, and Soulbound tokens represent this future.

Challenges Ahead:

- Regulatory uncertainty continues to inhibit growth in some jurisdictions.

- Scalability remains a hurdle for blockchains like Ethereum, though solutions are emerging.

- Security issues and high-profile exploits undermine trust.

- User experience is still complex for non-technical users—wallets, keys, bridges can be intimidating.

- Market cycles can be volatile, with boom-bust dynamics (e.g., 2021 bull run vs. 2022 crash).

3. “Crypto Future” as a Specific Project or Brand

Another possible interpretation is that “Crypto Future” refers to a specific project, token, app, or company with that name. There are numerous startups and tokens using similar titles, especially given how broad and catchy the term is.

Examples (Note: May vary depending on current trends or naming collisions):

- CryptoFuture (CRF Token) – A project that once claimed to offer AI and blockchain-powered financial services (many such projects turned out to be scams, so caution is advised).

- Crypto Future Academy / Crypto Future App – Educational platforms or trading tools.

Important:

If you are referring to a particular project named “Crypto Future,” please provide the following:

- Official website or app name.

- Token symbol, if applicable.

- Any social media or exchange listing info.

Always do thorough research (DYOR) before investing in or promoting lesser-known projects, as many use “futuristic” branding to lure in investors without delivering value.

Final Thoughts

The phrase “crypto future” is multi-layered:

- It can mean the futures contracts used for trading digital assets.

- It can refer to the long-term vision for the crypto ecosystem.

- Or it could point to a specific project using “Crypto Future” in its branding.

Understanding the context is essential, especially in a rapidly evolving industry like crypto. Whether you’re a trader exploring futures markets, an investor planning for the next decade, or a newcomer looking at a promising-sounding app, knowing what “crypto future” means to you is the first step toward making informed decisions.

-

Top Media & Entertainment Tokens Fueling the Digital Revolution: 15 Game-Changers to Watch

Top Media & Entertainment Tokens Fueling the Digital Revolution: 15 Game-Changers to Watch

Meta Description:

Top Media & Entertainment Tokens are reshaping the digital content world. Discover 15 powerful tokens revolutionizing how we engage with entertainment.

📋 Comprehensive Article Outline

Heading Level Section Title H1 Top Media & Entertainment Tokens Fueling the Digital Revolution H2 Introduction to Media & Entertainment Tokens H2 Why Crypto is Disrupting Media & Entertainment H2 Benefits of Media & Entertainment Tokens H2 How Blockchain Enables True Content Ownership H2 Token #1: Audius (AUDIO) – Decentralized Music Streaming H2 Token #2: Theta Network (THETA) – Next-Gen Video Streaming H2 Token #3: Chiliz (CHZ) – Fan Tokens for Sports & Esports H2 Token #4: Verasity (VRA) – Fighting Ad Fraud in Video H2 Token #5: Emanate (EMT) – Real-Time Music Monetization H2 Token #6: Decentraland (MANA) – Virtual Concerts & Performances H2 Token #7: Livepeer (LPT) – Open Video Infrastructure H2 Token #8: Viberate (VIB) – Analytics for Music Industry H2 Token #9: Render Token (RNDR) – GPU Rendering for Visual Content H2 Token #10: Audioboom (AIM) – Podcasting on the Blockchain H2 Token #11: BitSong (BTSG) – Empowering Independent Artists H2 Token #12: Ujo Music (UJO) – Music Rights Management H2 Token #13: Sora (XOR) – Collaborative Production Ecosystem H2 Token #14: AIOZ Network (AIOZ) – Distributed CDN for Entertainment H2 Token #15: Myco (MYCO) – Watch-to-Earn Entertainment Platform H2 How to Invest in Media & Entertainment Tokens H2 Risks to Consider Before Investing H2 Future Outlook: Where the Industry is Heading H2 FAQs H3-H6 (Within FAQs) H2 Conclusion: The Creative Economy Reimagined

✅ Introduction to Media & Entertainment Tokens

The rise of media & entertainment tokens is revolutionizing how we engage with digital content. Blockchain technology is not only decentralizing traditional structures but also giving power back to content creators and fans. In a digital era defined by streaming, gaming, and virtual interactions, these tokens are reshaping the entertainment economy.

With platforms like Audius, Theta, and Chiliz, blockchain has carved out a niche that’s rapidly expanding into mainstream usage. Let’s explore why these tokens matter and the game-changing role they play.

🚀 Why Crypto is Disrupting Media & Entertainment

Blockchain is disrupting this industry by solving long-standing problems:

- Intermediary Overload: Traditional models favor large corporations over artists.

- Limited Monetization Options: Content creators often rely on ads or third-party platforms.

- Censorship & Ownership Issues: Centralized control can stifle creativity.

Crypto tokens address these by enabling:

- Direct creator-to-fan payments

- Transparent royalty systems

- Content ownership through NFTs

This transformation is empowering users globally—especially in emerging creator economies.

🎯 Benefits of Media & Entertainment Tokens

These tokens offer tangible advantages:

Benefit Explanation Creator Empowerment Artists monetize directly without intermediaries. Fan Engagement Fans own part of the ecosystem (e.g., fan tokens). Censorship Resistance Decentralized platforms prevent arbitrary takedowns. Micro-Payments Easily support creators with small token amounts. Royalties Tracking Smart contracts automate and verify payouts.

🔐 How Blockchain Enables True Content Ownership

NFTs and smart contracts redefine how ownership is perceived in media:

- Music: Artists can sell songs as NFTs with embedded royalties.

- Video: Viewers can “own” episodes or clips via tokenized licenses.

- Virtual Goods: Digital concert tickets, merchandise, and collectibles.

Smart contracts ensure transparent ownership, enforce creator rights, and build community loyalty.

🎧 Token #1: Audius (AUDIO) – Decentralized Music Streaming

Audius is a decentralized streaming platform that lets artists publish without intermediaries. It has:

- Over 6 million users

- Direct fan support via AUDIO token tips

- NFT integrations for music ownership

It’s a favorite among indie musicians who value control and transparency.

Explore more: https://audius.co

📺 Token #2: Theta Network (THETA) – Next-Gen Video Streaming

Theta improves video delivery using decentralized infrastructure. Instead of relying on centralized servers, users share bandwidth and earn THETA tokens.

- Reduces video delivery costs

- Boosts streaming speed and quality

- Used by Samsung, Google, and MGM

🎮 Token #3: Chiliz (CHZ) – Fan Tokens for Sports & Esports

Chiliz powers fan tokens for top sports teams and esports brands. Fans can:

- Vote on team decisions

- Access exclusive content

- Trade tokens on Socios.com

It brings blockchain utility to global fandoms.

🎥 Token #4: Verasity (VRA) – Fighting Ad Fraud in Video

Verasity tackles video ad fraud using Proof-of-View (PoV) technology.

- Verifies legitimate views

- Enhances ad revenue for creators

- Powers esports and content streaming platforms

🎵 Token #5: Emanate (EMT) – Real-Time Music Monetization

Emanate pays artists in real-time as listeners stream their music.

- Enables instant royalty payouts

- Artists keep more revenue

- Collaboration-friendly platform

🌐 Token #6: Decentraland (MANA) – Virtual Concerts & Performances

Decentraland lets users buy virtual land and host digital concerts, art shows, and more.

- Used by artists like Grimes and Deadmau5

- Virtual merch and NFTs are sold using MANA

- Fans experience performances in the metaverse

📡 Token #7: Livepeer (LPT) – Open Video Infrastructure

Livepeer is a decentralized video streaming network.

- Reduces infrastructure costs

- Great for small creators and startups

- Utilizes Ethereum for smart contracts

📊 Token #8: Viberate (VIB) – Analytics for Music Industry

Viberate offers blockchain-powered music analytics and artist profiles.

- Helps promoters and labels make decisions

- Tracks performance, engagement, and fan base

- Monetizes artist data with VIB token

🎨 Token #9: Render Token (RNDR) – GPU Rendering for Visual Content

RNDR taps into unused GPU power to render visual content for creators.

- Ideal for VFX, animations, and gaming

- Decentralizes rendering workloads

- Reduces time and cost for visual projects

🎙️ Token #10: Audioboom (AIM) – Podcasting on the Blockchain

Audioboom is merging blockchain with podcasting.

- Enables token-based monetization

- Distributes earnings fairly

- Encourages niche content growth

🎤 Token #11: BitSong (BTSG) – Empowering Independent Artists

BitSong allows artists to:

- Upload and monetize music

- Receive tips and donations

- Interact directly with fans

🎼 Token #12: Ujo Music (UJO) – Music Rights Management

Ujo focuses on music licensing and rights management via smart contracts.

- Tracks song usage

- Manages ownership splits

- Makes royalty collection transparent

🧠 Token #13: Sora (XOR) – Collaborative Production Ecosystem

Sora supports community-driven media creation.

- Decentralized funding

- Tokenized collaboration tools

- Promotes shared ownership

🌍 Token #14: AIOZ Network (AIOZ) – Distributed CDN for Entertainment

AIOZ is a distributed content delivery network (CDN).

- Speeds up streaming services

- Cuts costs for content providers

- Incentivizes viewers to share bandwidth

🎁 Token #15: Myco (MYCO) – Watch-to-Earn Entertainment Platform

Myco rewards users for watching and engaging with content.

- Viewers earn MYCO tokens

- Tokens can be spent in-platform

- Built-in NFT marketplace for rewards

💰 How to Invest in Media & Entertainment Tokens

You can buy most tokens on major exchanges like Binance, Coinbase, or KuCoin. Here’s a basic process:

- Create an exchange account

- Fund your wallet (USD, ETH, etc.)

- Search for the token symbol (e.g., AUDIO)

- Buy and store in a secure wallet

Always do your own research and never invest more than you can afford to lose.

⚠️ Risks to Consider Before Investing

Despite the buzz, there are risks:

- Volatility: Prices can swing dramatically

- Regulatory Changes: Unclear legal framework in some regions

- Adoption Barriers: Mass user onboarding can be slow

- Platform Longevity: Some projects may fade without sustained user interest

Stay informed and diversify your crypto portfolio.

🔮 Future Outlook: Where the Industry is Heading

The fusion of blockchain with media is just beginning:

- NFTs as mainstream music distribution

- Virtual reality concerts using crypto

- Cross-platform content monetization

As Web3 matures, media tokens will redefine creativity, community, and ownership. The creator economy is evolving fast—and these 15 tokens are leading the charge.

❓ Frequently Asked Questions

Q1: What are Media & Entertainment Tokens?

They’re cryptocurrencies used in platforms focused on music, video, gaming, or content creation, enabling decentralized control and monetization.

Q2: Are these tokens only for creators?

No. Fans, investors, and developers also benefit by participating in ecosystems and earning rewards.

Q3: Can I earn passive income with these tokens?

Yes, some offer staking rewards, advertising revenue share, or Watch-to-Earn models.

Q4: How are these tokens different from NFTs?

Tokens are fungible and used for payments or governance. NFTs represent unique digital assets like songs or video clips.

Q5: Which token is best for music lovers?

Audius, BitSong, and Emanate are great options focused on empowering musicians and fans alike.

Q6: Are media tokens safe to invest in?

They come with typical crypto risks. Research thoroughly, use secure wallets, and follow trusted exchanges.

🏁 Conclusion: The Creative Economy Reimagined

Media & entertainment tokens are not just hype—they’re shaping a new creative economy. With decentralized tools, artists regain control, fans gain access, and innovation thrives.

From streaming to sports, virtual worlds to analytics, these 15 tokens prove the future of entertainment is decentralized, borderless, and community-powered.

-

Bitcoin Cash Breakthrough: 10 Reasons Why It’s Reshaping Digital Finance

Bitcoin Cash Breakthrough: 10 Reasons Why It’s Reshaping Digital Finance

Meta Description: Bitcoin Cash is redefining the digital financial space. Explore 10 powerful reasons why Bitcoin Cash is leading the charge in crypto innovation.

📋 Comprehensive Article Outline

Heading Level Section Title H1 Bitcoin Cash Breakthrough: 10 Reasons Why It’s Reshaping Digital Finance H2 What is Bitcoin Cash (BCH)? H2 The Origins of Bitcoin Cash: A Brief History H2 1. Faster Transactions: Speed That Outruns Bitcoin H2 2. Lower Transaction Fees: Saving Every Satoshi H2 3. Scalability for the Future: A Blockchain Built to Grow H2 4. Real-World Usability: BCH in Everyday Life H2 5. Strong Community Support and Development H2 6. Security and Decentralization H2 7. Smart Contract Capabilities with CashTokens H2 8. Merchant Adoption: BCH for Businesses H2 9. Environmental Sustainability: Greener Crypto Transactions H2 10. BCH’s Role in Financial Inclusion H2 BCH vs. BTC: Key Differences That Matter H2 Risks and Considerations H2 Future Outlook for Bitcoin Cash H2 FAQs About Bitcoin Cash H2 Conclusion

🪙 What is Bitcoin Cash (BCH)?

Bitcoin Cash (BCH) is a decentralized cryptocurrency that forked from Bitcoin in 2017. Designed to offer faster and cheaper transactions, it enables peer-to-peer electronic cash that’s scalable and accessible to everyone globally. The primary goal of BCH is to serve as a practical medium of exchange, aligning more closely with Satoshi Nakamoto’s original vision for Bitcoin.

🕰 The Origins of Bitcoin Cash: A Brief History

Bitcoin Cash emerged from a philosophical and technical rift within the Bitcoin community. As Bitcoin grew in popularity, its limited block size (1MB) led to slow transaction speeds and higher fees. To solve this, a faction proposed increasing the block size. When the idea was rejected by Bitcoin core developers, Bitcoin Cash was born via a hard fork, starting with an 8MB block size and now supporting even larger sizes.

⚡ 1. Faster Transactions: Speed That Outruns Bitcoin

One of the most compelling advantages of Bitcoin Cash is its superior transaction speed. While Bitcoin struggles with congestion due to its smaller block size, BCH processes more transactions per second thanks to its larger blocks.

Why Speed Matters:

- BCH can process over 100 transactions per second.

- Transactions typically confirm within seconds, not minutes or hours.

- Enables real-time payments in retail, e-commerce, and person-to-person transfers.

Feature Bitcoin (BTC) Bitcoin Cash (BCH) Block Size 1 MB 32 MB TPS (Transactions per Second) ~7 100+ Avg. Confirmation Time 10 min+ Under 1 minute

💰 2. Lower Transaction Fees: Saving Every Satoshi

Transaction fees on Bitcoin Cash are dramatically lower than on Bitcoin and Ethereum. This makes BCH more suitable for microtransactions and daily use.

- Typical BCH transaction fees: less than $0.01

- Bitcoin fees during congestion: $5–$50+

- Ethereum fees (gas): fluctuate wildly

Lower fees empower users in developing countries and make BCH more accessible for small purchases.

🔗 3. Scalability for the Future: A Blockchain Built to Grow

Unlike many blockchains that slow down under pressure, Bitcoin Cash is designed to scale. Its larger block size allows it to handle tens of thousands of transactions per block, ensuring low congestion and high reliability even during spikes in usage.

Key Scalability Features:

- Dynamic block sizes (up to 32MB)

- Efficient on-chain scaling

- Regular upgrades from the BCH developer community

🛍 4. Real-World Usability: BCH in Everyday Life

Bitcoin Cash is not just for crypto enthusiasts — it’s for everyone. BCH is being accepted across a growing number of merchants, websites, and apps.

Where You Can Spend BCH:

- Retail Stores: Via apps like Bitcoin.com Wallet and Flexa

- Online Marketplaces: Newegg, Namecheap, and others

- Peer-to-peer Transactions: Via mobile wallets and QR codes

👥 5. Strong Community Support and Development

The BCH ecosystem is developer-driven and community-focused. Multiple teams contribute to its core protocol, including Bitcoin ABC, BCHN, and others, ensuring decentralization and innovation.

Community Highlights:

- Multiple full-node implementations

- Community governance via open forums

- Transparent decision-making and upgrades

🔐 6. Security and Decentralization

Security is foundational to Bitcoin Cash. It uses the same SHA-256 encryption as Bitcoin, making it incredibly secure. Its decentralized network of nodes prevents any single point of failure or control.

- Proof-of-Work consensus mechanism

- Transparent ledger on public blockchain

- Global node distribution

💡 7. Smart Contract Capabilities with CashTokens

With the 2023 upgrade, BCH introduced CashTokens, a new feature enabling smart contracts and token creation directly on the Bitcoin Cash blockchain.

Benefits of CashTokens:

- NFTs and fungible tokens support

- DApps without high fees

- Programmable payment systems

This turns BCH into a smart contract platform, expanding its use cases well beyond just payments.

🛒 8. Merchant Adoption: BCH for Businesses

Bitcoin Cash is increasingly popular with merchants due to its low fees, fast confirmation times, and ease of integration.

Merchant Benefits:

- No chargebacks

- Instant settlement

- BCH payment plugins for WooCommerce, Shopify, and more

External resource: Accept BCH with Bitcoin.com Pay

🌱 9. Environmental Sustainability: Greener Crypto Transactions

Unlike Ethereum or older versions of Bitcoin, BCH transactions are energy-efficient.

- Low electricity requirements per transaction

- Supports green mining initiatives

- Smaller carbon footprint vs. BTC and ETH

This makes BCH an eco-friendly option in a world increasingly concerned with sustainability.

🌍 10. BCH’s Role in Financial Inclusion

Millions of people worldwide remain unbanked. BCH provides them with access to a global financial system with just a smartphone.

Why BCH Helps:

- No need for bank accounts

- Works in low-bandwidth environments

- Stable and fast mobile wallets

This democratizes financial access and gives economic power to underserved populations.

⚔ BCH vs. BTC: Key Differences That Matter

Feature Bitcoin (BTC) Bitcoin Cash (BCH) Speed Slower Faster Fees Higher Lower Block Size 1 MB 32 MB Smart Contracts Limited (via RSK) Native via CashTokens Usability Store of value Medium of exchange

⚠ Risks and Considerations

Like all cryptocurrencies, Bitcoin Cash comes with some risks:

- Market volatility

- Regulatory uncertainty

- Lower adoption compared to Bitcoin

However, its strengths in speed, fees, and scalability make it a compelling long-term contender.

🔮 Future Outlook for Bitcoin Cash

The future of BCH looks promising. With continued development, growing adoption, and new innovations like CashTokens, BCH is poised to play a major role in the future of finance.

Upcoming Milestones:

- Layer 2 payment channels

- Broader smart contract integration

- Increased institutional adoption

❓ FAQs About Bitcoin Cash

1. Is Bitcoin Cash the same as Bitcoin?

No. Bitcoin Cash is a separate blockchain created via a hard fork from Bitcoin in 2017. While it shares the same codebase, it has key differences in transaction speed, fees, and philosophy.

2. How can I buy Bitcoin Cash?

You can purchase BCH on most major exchanges like Binance, Coinbase, and Kraken. It’s also available via peer-to-peer platforms.

3. Is Bitcoin Cash safe to use?

Yes. It uses the same security protocols as Bitcoin, including SHA-256 encryption and Proof-of-Work consensus.

4. Can I use BCH for everyday purchases?

Absolutely. BCH is accepted by many merchants globally and is designed for fast, low-cost transactions.

5. What is the future price potential of BCH?

While no one can predict prices, many analysts see BCH’s low fees and scalability as strong long-term value drivers.

6. How does BCH compare to Ethereum?

Ethereum focuses on smart contracts and DApps, while BCH is optimized for payments. With CashTokens, BCH is bridging that gap.

🏁 Conclusion

Bitcoin Cash stands as one of the most underrated yet powerful players in the cryptocurrency space. With its fast, low-cost, scalable infrastructure and growing ecosystem, BCH is reshaping how the world views digital finance.

Whether you’re a newcomer or crypto veteran, now’s the time to consider how Bitcoin Cash fits into your financial future.

-

Central Bank Digital Currencies (CBDCs): The Future of Money

What Are Central Bank Digital Currencies (CBDCs)?

Central Bank Digital Currencies (CBDCs) are a new form of digital money issued and regulated by a country’s central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, CBDCs are state-backed and represent a digital form of a nation’s fiat currency. These currencies combine the convenience of digital transactions with the trust and legal backing of a central authority, offering a seamless and secure payment system.

CBDCs are designed to function as a medium of exchange, store of value, and unit of account, just like traditional paper currencies. However, their digital nature allows for instantaneous transactions, reduced costs, and improved transparency across the financial system.

Types of CBDCs: Retail vs. Wholesale

There are two main types of CBDCs, each targeting different use cases:

Retail CBDCs

Retail CBDCs are intended for general public use, enabling individuals and businesses to conduct everyday transactions. They function much like digital cash and are accessible through mobile apps, smart cards, or digital wallets. Retail CBDCs can be account-based or token-based, depending on how user identity and transactions are verified.

Wholesale CBDCs

Wholesale CBDCs are designed for use by financial institutions, such as banks and payment processors. They facilitate interbank settlements and large-scale financial operations, improving efficiency, reducing settlement risks, and streamlining liquidity management.

Key Features of CBDCs

CBDCs possess several key features that distinguish them from both physical cash and cryptocurrencies:

- Centralized Authority: Issued and regulated by the central bank.

- Legal Tender: Recognized as official currency, fully backed by the government.

- Programmable Money: Capable of smart contract integration for automated compliance and transactions.

- Traceability: Enables robust monitoring and tracking to combat fraud and illicit activities.

- Financial Inclusion: Extends banking services to unbanked or underbanked populations.

- Interoperability: Designed to integrate with existing financial systems and global payment networks.

Benefits of Central Bank Digital Currencies

1. Enhanced Payment Efficiency

CBDCs enable instant, low-cost, and cross-border transactions, eliminating intermediaries and reducing operational friction. This leads to faster settlements, improved cash flow, and optimized supply chains for businesses.

2. Financial Stability and Control

With CBDCs, central banks can exercise direct control over monetary policy, interest rates, and inflation, offering greater resilience during financial crises. Real-time data from digital currencies allows better economic forecasting and policy decisions.

3. Combating Financial Crime

The traceability of CBDCs allows governments to monitor illicit activities, such as money laundering, tax evasion, and terrorism financing. Programmable oversight ensures transactions are compliant with regulations, enhancing overall security.

4. Reducing Costs of Physical Cash

Maintaining and distributing paper currency is expensive. CBDCs eliminate many of these costs, including printing, transportation, and storage, making them a cost-effective alternative to traditional cash.

5. Promoting Financial Inclusion

CBDCs can reach populations with limited access to traditional banking infrastructure. By using mobile wallets or smart devices, even those in rural or underserved areas can participate in the formal financial system.

Challenges and Concerns Around CBDCs

Despite the potential benefits, CBDCs also raise significant concerns:

1. Privacy Issues

The ability of governments to monitor every transaction may lead to loss of personal privacy and raise concerns about mass surveillance.

2. Cybersecurity Threats

As digital assets, CBDCs are susceptible to hacking, cyberattacks, and system vulnerabilities. Ensuring robust encryption, secure architecture, and disaster recovery plans is critical.

3. Disintermediation of Banks

Direct CBDC issuance might lead to reduced reliance on commercial banks, potentially destabilizing the existing financial ecosystem and threatening the credit creation process.

4. Technological Barriers

Implementing a secure, scalable, and user-friendly CBDC infrastructure requires significant technological investment, coordination, and public trust.

CBDCs Around the World: Global Developments

Countries across the globe are actively exploring or piloting CBDC projects. Here are some notable examples:

China: Digital Yuan (e-CNY)

China is leading the CBDC race with its Digital Yuan, already rolled out in several cities. The People’s Bank of China aims to enhance payment systems and reduce dependence on the dollar.

European Union: Digital Euro

The European Central Bank is developing a Digital Euro to maintain monetary sovereignty and ensure safe, efficient digital payments within the eurozone.

United States: Digital Dollar

The Federal Reserve is exploring the Digital Dollar to address financial innovation, stablecoins, and maintain the USD’s global dominance in digital transactions.

India: e-Rupee

India launched pilot projects for the Retail and Wholesale Digital Rupee, focusing on increasing financial inclusion and modernizing the payment landscape.

Bahamas: Sand Dollar

The Bahamas was among the first to launch a live CBDC, the Sand Dollar, aimed at improving access to financial services in remote islands.

CBDCs vs. Cryptocurrencies: Key Differences

While both CBDCs and cryptocurrencies exist in the digital realm, they are fundamentally different:

Feature CBDCs Cryptocurrencies Issuer Central Banks Decentralized Entities Regulation Fully Regulated Partially or Unregulated Legal Tender Yes No Volatility Stable Highly Volatile Anonymity Limited Often High (e.g., Bitcoin) Use Case National Payments Investment, Transactions, Store of Value

The Role of CBDCs in the Future Economy

CBDCs are not just a new payment mechanism—they represent a transformation of the global monetary system. By combining the efficiency of digital technology with regulatory oversight, CBDCs could potentially:

- Reshape international remittances and cross-border trade

- Enhance the efficiency of central bank operations

- Act as a counterbalance to private digital currencies

- Support climate goals by reducing paper and coin production

CBDCs are also likely to integrate with emerging technologies like blockchain, artificial intelligence, and IoT, expanding their utility across various sectors.

How Businesses and Consumers Can Prepare

The rise of CBDCs will demand adaptation and digital literacy. Businesses should:

- Update payment systems to support digital currencies

- Invest in cybersecurity and compliance tools

- Educate staff and customers on safe CBDC usage

Consumers, meanwhile, should explore CBDC-compatible wallets, learn about privacy settings, and stay informed about policy changes from central banks.

Conclusion: Embracing the Digital Currency Era

Central Bank Digital Currencies are poised to redefine how we use, manage, and perceive money. While challenges remain, the momentum behind CBDCs is undeniable. As nations race toward digital transformation, staying informed and prepared is no longer optional—it’s essential.

If you want to read more information about how to boost traffic on your Website just visit –> The Insider’s Views.

-

Ethereum Mastery: 15 Game-Changing Insights into the Future of Crypto

Meta Description: Ethereum is revolutionizing crypto with smart contracts, DeFi, and Web3. Discover 15 powerful insights into how Ethereum is shaping the future.

📋 Comprehensive Article Outline

Heading Level Heading H1 Ethereum Mastery: 15 Game-Changing Insights into the Future of Crypto H2 1. What Is Ethereum and Why It Matters H2 2. Ethereum vs Bitcoin: Key Differences H2 3. Ethereum’s Transition to Proof of Stake (PoS) H2 4. Understanding Ethereum Smart Contracts H2 5. How Ethereum Powers the DeFi Revolution H2 6. NFTs on Ethereum: More Than Just Digital Art H2 7. Web3 and Ethereum: A Decentralized Internet H2 8. The Role of ETH in the Ethereum Ecosystem H2 9. Ethereum Gas Fees Explained H2 10. Ethereum Layer 2 Scaling Solutions H2 11. Ethereum Security: Is It Really Safe? H2 12. Top Ethereum Wallets for Investors H2 13. Ethereum Price Predictions and Market Trends H2 14. How to Stake Ethereum Safely H2 15. The Future of Ethereum: What’s Next? H2 FAQs About Ethereum H3 Conclusion H3 External Resource

🧠 1. What Is Ethereum and Why It Matters

Ethereum is a decentralized blockchain platform that enables smart contracts and decentralized applications (dApps) to run without any downtime, fraud, control, or interference from a third party. Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum goes beyond simple currency transfer—it’s the foundation for the decentralized future.

Key Benefits of Ethereum:

- Smart contracts automate agreements

- DeFi platforms use Ethereum for trustless financial services

- Developers build scalable dApps with global reach

Ethereum matters because it democratizes access to finance, ownership, and innovation. It’s not just a cryptocurrency—it’s the backbone of Web3.

🔁 2. Ethereum vs Bitcoin: Key Differences

Although both are cryptocurrencies, Ethereum and Bitcoin serve distinct purposes.

Feature Ethereum Bitcoin Purpose Programmable contracts, dApps Digital currency Block Time ~13 seconds ~10 minutes Consensus Mechanism Proof of Stake (PoS) Proof of Work (PoW) Smart Contracts Yes No Supply Cap Unlimited 21 million BTC Takeaway: Bitcoin is digital gold; Ethereum is a decentralized supercomputer. They’re complementary, not competitors.

🔄 3. Ethereum’s Transition to Proof of Stake (PoS)

With the Ethereum Merge in September 2022, Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS). This shift drastically reduced Ethereum’s energy consumption by over 99%.

Advantages of PoS:

- Energy efficient

- More scalable

- Promotes decentralization

Fun Fact: Ethereum’s energy use now rivals that of a small town rather than a nation.

💡 4. Understanding Ethereum Smart Contracts

Smart contracts are self-executing contracts with the terms written directly into code. They operate on the Ethereum blockchain and eliminate intermediaries.

Smart Contract Use Cases:

- Decentralized finance (DeFi)

- Supply chain tracking

- Real estate tokenization

- Gaming and digital identity

These contracts are immutable, transparent, and highly secure, revolutionizing industries.

💰 5. How Ethereum Powers the DeFi Revolution

DeFi, or Decentralized Finance, runs largely on Ethereum. This ecosystem allows users to borrow, lend, trade, and earn interest—all without traditional banks.

Popular DeFi Protocols:

- Uniswap (DEX)

- Aave (Lending)

- Compound (Interest accounts)

Why It Matters: Ethereum DeFi gives global access to financial tools, especially in underbanked regions.

🎨 6. NFTs on Ethereum: More Than Just Digital Art

Ethereum hosts the majority of NFT (Non-Fungible Token) projects, from art to music to virtual real estate.

Top NFT Marketplaces:

- OpenSea

- Rarible

- Foundation

Real World Use Cases:

- Digital identity

- Event ticketing

- Intellectual property rights

NFTs aren’t just collectibles—they’re redefining ownership.

🌐 7. Web3 and Ethereum: A Decentralized Internet

Web3 envisions a decentralized internet, and Ethereum is its heart. Unlike Web2 (dominated by centralized giants), Web3 runs on protocols like Ethereum.

Key Features:

- User-owned data

- No central servers

- Token-based economies

Applications: DAOs, dApps, decentralized storage, social media.

🪙 8. The Role of ETH in the Ethereum Ecosystem

ETH is Ethereum’s native currency, and it does more than just hold value.

ETH Functions:

- Pays gas fees for transactions

- Staked to secure the network

- Used as collateral in DeFi

Owning ETH gives you access to the full Ethereum ecosystem.

⛽ 9. Ethereum Gas Fees Explained

Gas fees are the cost of using the Ethereum network, paid in ETH. They depend on:

- Transaction complexity

- Network congestion

- Desired speed (Gwei setting)

Tips to Reduce Fees:

- Use during off-peak hours

- Batch transactions

- Use Layer 2 solutions

📈 10. Ethereum Layer 2 Scaling Solutions

To reduce congestion and gas fees, Ethereum employs Layer 2 networks.

Popular Layer 2s:

- Arbitrum

- Optimism

- zkSync

These platforms process transactions off-chain and settle on Ethereum, improving speed and cost.

🛡️ 11. Ethereum Security: Is It Really Safe?

Ethereum is one of the most secure blockchain networks, but it’s not invincible.

Security Strengths:

- Transparent codebase

- Auditable smart contracts

- Large developer community

Risks:

- Exploited vulnerabilities in dApps

- Human error in contract code

Best Practices:

- Use audited protocols

- Avoid phishing

- Use hardware wallets

🔐 12. Top Ethereum Wallets for Investors

Choosing the right wallet ensures your ETH and assets stay safe.

Wallet Type Examples Pros Hardware Ledger, Trezor Very secure Software MetaMask, Trust Wallet User-friendly Web MyEtherWallet Quick access Cold wallets are best for long-term storage, while hot wallets are ideal for daily use.

📊 13. Ethereum Price Predictions and Market Trends

ETH has shown strong long-term growth, and many experts believe it could surpass previous all-time highs.

Analyst Predictions:

- Short-term: $3,000–$4,500

- Long-term: $10,000+

Market Drivers:

- Institutional adoption

- Layer 2 expansion

- Increasing utility in DeFi and NFTs

Reminder: Crypto markets are volatile. Always do your own research (DYOR).

🧱 14. How to Stake Ethereum Safely

Staking ETH lets users earn passive income while securing the network.

How to Stake:

- Solo validator (32 ETH)

- Join staking pools

- Use exchanges like Coinbase or Binance

Risks:

- Slashing for malicious activity

- Lock-up periods

Pro Tip: Use trusted staking services with good reputations.

🚀 15. The Future of Ethereum: What’s Next?

Ethereum’s roadmap includes major upgrades like:

- Danksharding for scalability

- Verkle trees to reduce storage needs

- Account abstraction for smoother UX

Ethereum is constantly evolving to support millions of users and billions of daily transactions.

Quote from Vitalik: “The Ethereum ecosystem is becoming the open-source version of the Internet.”

❓ FAQs About Ethereum

1. What makes Ethereum different from Bitcoin?

Ethereum is programmable, allowing for smart contracts and dApps, while Bitcoin is primarily a digital currency.

2. Is Ethereum a good investment?

Ethereum has strong fundamentals, but like all crypto assets, it’s volatile. Always assess your risk tolerance.

3. What are gas fees in Ethereum?

They’re transaction costs paid in ETH, varying based on network congestion and complexity.

4. Can I earn passive income with Ethereum?

Yes, through staking ETH or participating in DeFi protocols.

5. Is Ethereum secure?

Yes, but risks exist. Use audited platforms and secure wallets.

6. What’s next for Ethereum’s development?

Upgrades like Danksharding and improved scalability are on the horizon.

📚 Conclusion

Ethereum is not just another cryptocurrency—it’s a technology revolutionizing finance, art, the internet, and beyond. With its advanced smart contract capabilities, strong developer community, and clear future roadmap, Ethereum is paving the way for a decentralized, inclusive, and innovative digital future

-

Top 7 Powerful Types of Cryptocurrency You Need to Know in 2025

Top 7 Powerful Types of Cryptocurrency You Need to Know in 2025

Meta Description:

Cryptocurrency types explained with examples. Discover 7 powerful types of cryptocurrencies dominating the digital economy in 2025.

📘 Comprehensive Article Outline

Section Heading Level Title 1 H1 Top 7 Powerful Types of Cryptocurrency You Need to Know in 2025 2 H2 Introduction to Cryptocurrency 3 H2 1. Payment Cryptocurrencies 4 H3 Examples of Payment Cryptos 5 H3 Key Features and Use Cases 6 H2 2. Stablecoins 7 H3 Why Stability Matters 8 H3 Top Stablecoins in 2025 9 H2 3. Utility Tokens 10 H3 Role of Utility Tokens in Blockchain Ecosystems 11 H3 Common Utility Token Projects 12 H2 4. Security Tokens 13 H3 How Security Tokens Differ from Other Types 14 H3 Regulatory Importance of Security Tokens 15 H2 5. Governance Tokens 16 H3 Enabling Decentralized Governance 17 H3 Examples of Governance Tokens 18 H2 6. Non-Fungible Tokens (NFTs) 19 H3 How NFTs Revolutionized Digital Ownership 20 H3 Top NFT Platforms in 2025 21 H2 7. Privacy Coins 22 H3 Why Privacy Coins Matter 23 H3 Top Privacy-Focused Cryptocurrencies 24 H2 Differences Between Coin and Token 25 H2 How to Choose the Right Type of Cryptocurrency 26 H2 FAQs 27 H2 Conclusion

Introduction to Cryptocurrency

Cryptocurrency has taken the world by storm over the past decade, and it’s not slowing down in 2025. From everyday payments to smart contracts and decentralized apps, the types of cryptocurrency available today serve various purposes in our increasingly digital lives.

Understanding the different categories of cryptocurrency isn’t just helpful—it’s essential. Whether you’re a beginner or an experienced investor, knowing what each type does will help you navigate the space with confidence and clarity.

Let’s explore the top 7 powerful types of cryptocurrency dominating the blockchain universe in 2025.

1. Payment Cryptocurrencies

Payment cryptocurrencies are the most well-known type. These are designed to act as digital money—pure and simple. They allow users to send, receive, and store value securely, instantly, and often anonymously.

Examples of Payment Cryptos

- Bitcoin (BTC) – The original and most recognized.

- Litecoin (LTC) – Known as the silver to Bitcoin’s gold.

- Dash (DASH) – Focuses on fast and cheap transactions.

- Bitcoin Cash (BCH) – A spin-off of Bitcoin with larger block sizes.

Key Features and Use Cases

- Peer-to-peer transactions without intermediaries

- Borderless and permissionless payments

- Useful in high-inflation countries

- Increasing adoption by businesses and retailers

Payment coins are the backbone of decentralized finance and continue to see updates in scalability and transaction speed.

2. Stablecoins

Stablecoins were created to tackle the volatility often associated with crypto markets. Pegged to stable assets like the US dollar or gold, they provide a reliable store of value for traders and users alike.

Why Stability Matters

Crypto’s roller-coaster prices can scare off new adopters. Stablecoins provide a safe haven for traders and DeFi users during turbulent market conditions.

Top Stablecoins in 2025

- USDT (Tether) – Still the largest by market cap.

- USDC (USD Coin) – Backed by major financial institutions.

- DAI – A decentralized stablecoin backed by Ethereum.

- PYUSD – PayPal’s entry into the stablecoin space.

These tokens are crucial for trading pairs, DeFi, and cross-border remittances.

3. Utility Tokens

Unlike payment coins, utility tokens are built for specific use within a blockchain platform or ecosystem. They often grant users access to features or services.

Role of Utility Tokens in Blockchain Ecosystems

- Pay for smart contract operations (e.g., ETH on Ethereum)

- Access premium features or governance rights

- Fuel decentralized applications (DApps)

Common Utility Token Projects

- Ethereum (ETH) – Technically a coin, but works like a utility in the Ethereum network.

- BNB (Binance Coin) – Offers reduced fees and DeFi access on Binance Chain.

- Chainlink (LINK) – Powers oracle services.

- Basic Attention Token (BAT) – Used in the Brave browser ecosystem.

4. Security Tokens

Security tokens are digital representations of ownership in a real-world asset, like stocks, bonds, or real estate. They’re regulated and typically subject to securities laws.

How Security Tokens Differ from Other Types

Unlike utility tokens, security tokens must pass the Howey Test and are seen as investments. They provide holders with legal rights like dividends or profit shares.

Regulatory Importance of Security Tokens

- Registered with government bodies (e.g., SEC in the U.S.)

- Used in tokenized equity and fractional ownership models

- Offer more transparency and compliance

Projects like Polymath and tZero lead in this space.

5. Governance Tokens

Governance tokens let users participate in decision-making for blockchain projects. Think of it like voting rights in a shareholder meeting—but decentralized.

Enabling Decentralized Governance

- Users vote on project upgrades, changes, or fund allocation.

- Power lies with the community, not a central entity.

Examples of Governance Tokens

- UNI (Uniswap) – Users propose and vote on protocol updates.

- AAVE – Governance over lending protocol settings.

- COMP (Compound) – Manages interest rate models and treasury funds.

Governance tokens support the ethos of decentralization by empowering users with control.

6. Non-Fungible Tokens (NFTs)

NFTs are unique digital assets stored on a blockchain. They’re not interchangeable like traditional cryptocurrencies, making them ideal for collectibles and digital ownership.

How NFTs Revolutionized Digital Ownership

- Ownership of digital art, music, videos, and virtual land

- Provenance and authenticity verified on-chain

- Royalties for creators via smart contracts

Top NFT Platforms in 2025

- OpenSea – Still the largest NFT marketplace

- Blur – A new player for professional traders

- Rarible – Known for community-based governance

- Zora – Focused on creators and open editions

NFTs are expanding into gaming, education, virtual fashion, and even identity verification.

7. Privacy Coins

Privacy coins focus on anonymizing transactions. In a world where surveillance is rampant, these coins help preserve financial freedom and user privacy.

Why Privacy Coins Matter

- Prevent data leaks and tracking

- Used by activists and individuals in oppressive regimes

- Offers optional or default anonymity

Top Privacy-Focused Cryptocurrencies

- Monero (XMR) – The gold standard for anonymous payments

- Zcash (ZEC) – Offers both transparent and shielded transactions

- Dash (DASH) – PrivateSend feature for transaction obfuscation

Privacy coins are under regulatory scrutiny, but their importance in upholding privacy rights is undeniable.

Differences Between Coin and Token

Criteria Coin Token Native to Blockchain Yes (e.g., Bitcoin, Ethereum) No (runs on another chain) Used For Payments, gas fees Access, governance, utility Built On Own blockchain Existing blockchain (e.g., Ethereum) Example BTC, ETH USDT, UNI, LINK Understanding this difference helps you choose the right assets for investment or utility.

How to Choose the Right Type of Cryptocurrency

- Define Your Goal – Are you investing, trading, or building a project?

- Assess Risk Level – Stablecoins are less volatile; altcoins can swing wildly.

- Check Regulatory Status – Avoid tokens that may be deemed illegal securities.

- Use Case – Make sure the token has real-world utility and active development.

- Community and Support – Strong communities often indicate long-term viability.

FAQs

1. What is the most common type of cryptocurrency?

The most common type is payment cryptocurrency, like Bitcoin and Litecoin, used for sending and receiving digital money.

2. Are all tokens cryptocurrencies?

All tokens are part of the cryptocurrency ecosystem, but not all are used as currency. Some act as utility, security, or governance tools.

3. Is Ethereum a coin or a token?

Ethereum (ETH) is a coin because it runs on its own blockchain, even though it’s often used as a utility within the network.

4. What makes NFTs different from other cryptocurrencies?

NFTs are non-fungible, meaning each one is unique and cannot be swapped equally like Bitcoin or Ethereum.

5. Can I invest in all 7 types of cryptocurrency?

Yes, but you should diversify wisely based on your risk tolerance, goals, and market knowledge.

6. Where can I buy these different cryptocurrencies?

Major exchanges like Binance, Coinbase, and Kraken support a wide variety of crypto types. Always verify the token and contract address before buying.

Conclusion

The cryptocurrency world in 2025 is broader and more exciting than ever. From payment coins like Bitcoin to NFTs and privacy-focused coins, there’s something for every interest and use case. Understanding these 7 powerful types of cryptocurrency empowers you to navigate the digital economy wisely, securely, and with confidence.

As blockchain technology continues to evolve, new types of tokens and coins will emerge. Stay informed, stay cautious, and always do your own research.